What Is Dow Theory?

Essentially, Dow Theory is a concept of economics. The thesis is instituted on the notion that the market provides everything based on profound analysis. If any of the market’s averages outdoes the prior vital peak, the Dow Theory Forecast estimates that the market is on an upward trend (or uptrend). Similar progress in other averages is accompanied or followed by this. Until trends reappear, the various market indexes should basically validate each other in volume pattern and price action. Dow Technical Analysis, on the other hand, is a quick and straightforward technique to examine indexes. For specified time frames, the Dow Technical Analysis shows real-time estimates of the market’s movements. The theory has been revised several times over the years, but Dow and Hamilton’s basic assumptions, when forming it at the very beginning, remain unchanged. Taking a closer look at the Dow Theory Investment approach: Most trading techniques in use today are built on the single fundamental concept of a trend similar to what was introduced in 1882. Though Charles H. Dow’s work was a novel idea in the late 1800s when it was first introduced to the market, a Dow Theory investment is based on the trend approach, which may be bullish or bearish exactly as in wide use today. Also read: Pros and Cons of Online Stock Investment

The Significance of Dow Theory

You might be wondering why you need a Dow theory that is over a century old in the 21st century. The reality is that it is still pretty effective. It may be used to create a trading strategy, spot trends, and determine when the ideal moment is to join or take a break from the market. The Dow Theory Forecast is extremely important for your business. Virtually everything in commerce is dependent on market trends, as they are an essential component of trade. So before making any investment, investors look to see if the market is bullish or bearish, or at the very least, what the major trend is carrying. As a result, Dow Theory provides investors with a sense of market movements, allowing them to plan their business expedition without worry. Now, let’s look at the trading principles that make this theory special.

Six Principles of Dow Trading Theory

1. Everything is discounted on the market

Simply put, this method is the polar opposite of behavioral economics, as you may be familiar with it. Your winning potentials, managerial abilities, competitive advantage, and few more criteria will all determine how successful you will be in the market. Still, not every trader is conscious of this fact. Therefore, future occurrences are also described as hazards in a more thorough examination of this idea.

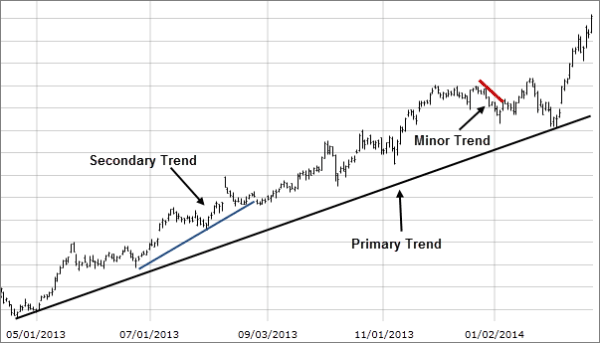

2. Market trends may be divided into three categories

Bull and bear markets, for example, are illustrations of main patterns that span a year or longer. They encounter secondary trends inside these broader ones, which often act against the main trend. The returns in a bull market or rallies in a bear market might be good examples. The majority of secondary trends endure three weeks to three months. But there are shorter movements which are mostly noise and only endures under three weeks.

Dow Theory Chart 1

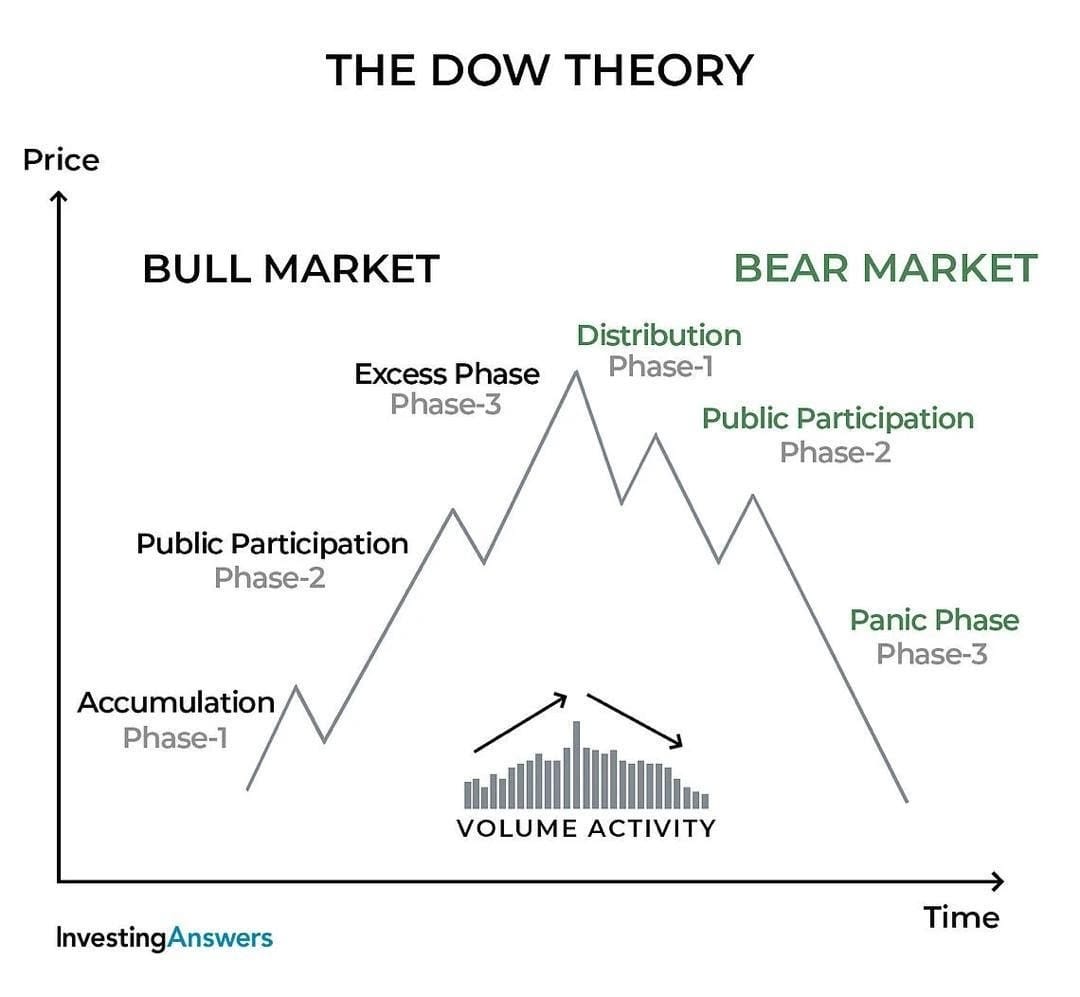

3. There are three stages to primary trends

The major or primary trend, according to Dow’s idea, passes through three phases. The bull market (uptrend) begins with collecting information, then moves on to the public involvement phase, and finally to the “surplus” phase. A bear market (downtrend) starts with a period of spread, followed by a period of public involvement, and finally, a period of panic. Therefore, after a significant drop, it is usually prudent to purchase (collect) an asset to prepare for the next bullish market or sell (distribute) an asset to prepare for the next bad market. As the price flips, the wider public follows suit, and traders who purchase eagerly at the top or sell fearfully at the bottom, end up with “pocket bags.”

Dow Theory Chart 2

4. The indices must be in agreement with one another

The Dow mentioned indexes or market averages must corroborate each other to identify a trend, implying that signals appearing in one index must correlate or coincide with signals appearing in another index. If one index confirms a new primary trend, such as the ones in the Dow Jones Industrial Average, while another index stays in a primary drop, traders should not conclude yet that a new trend has started.

Dow Theory Chart 3

5. The volume should indeed confirm the trend

When the price goes in the major trend direction, the volume should rise, and when it travels in the opposite direction, the volume should fall. The low volume suggests to tits observers that the trend is weakening. For comparison, volume must climb in a bull market when the price increases or decreases during the secondary exit. Thus, if volume rises during the retreat in this example, it might indicate that the trend will reverse as more market players turn bearish.

Dow Theory Chart 4

6. The trend will continue unless there is a definite reversal

If not careful enough, one may confuse the primary trend reversals with the secondary trend reversals. It’s pretty tough to predict if the bear market’s economic uncertainty is a turnaround or a short-term rebound that would lead to further lower lows. Therefore, Dow’s theory advises caution and emphasizes confirming the prospective reversal before going in.

Dow Theory Chart 5

Dow Trading Theories for day Traders

So, how can you put all this information about the Dow Theory mentioned above into a single routine for your day-to-day crypto trading? Theory 1: Allow the economists to make market forecasts as much as possible and investment analysts to forecast corporate profits. Day traders are unconcerned about this. Theory 2: View the chart’s three-time frames (multiple time frame analysis): the chart you’re buying and selling on, an extended time frame, and a shorter time frame. This will help you determine in which market phase you will find the latest trend. Theory 3: So that your daily investing reflects smart money move, keep in mind the broad picture (part of the main trend). Well-informed traders can exploit trends using tried-and-true methods. Theory 4: Look for similar assets that may be used to confirm each other. If you’re trading the forex market, look out for the dollar to control the movement of two or more currency pairs. Look for one or maybe more stock indexes that gauge the same stock if you’re trading indices. If you trade stocks, look for firms that are performing similarly. Theory 5: In the currency markets, merchant banks find it nearly hard to accept volume data. Volume may be used effectively by stock and futures traders to check price movements with comparative analysis. Theory 6: Before investing in a new path, wait for a reversal price pattern such as a double top, head, or shoulder pattern. Otherwise, consider each counter-trend move a correction and a chance to compete in the market at a lower price. Also read: Things to Do to Make Money While in College

Conclusion

The Dow Theory and its six concepts introduced over a century ago are still widely used today, and most traders believe it to be a viable trading technique. Moreover, the methods of Dow are also the foundation of everything we know about technical analysis today. As a result, you should not be found wanting with the Dow’s theory’s six fundamental principles as a financial operator utilizing technical analysis. Are you ready to double your profits by using these concepts in your day-to-day trading? Then, get on Redot to kick-start that profitable Crypto Trading journey NOW!

twitter facebook linkedin whatsapp

This subscription won’t wake you up in middle of the night, we are not your sweetheart! Register today for free and get notified on trending updates. I will never give away, trade or sell your email address. You can unsubscribe at any time.